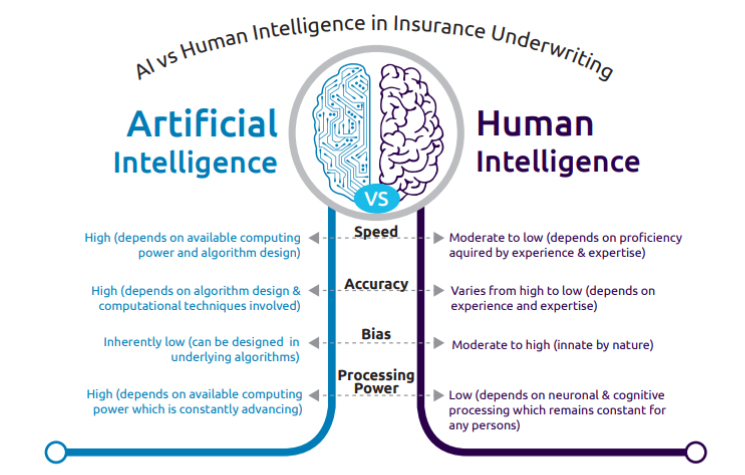

Changing the underwriting venture with our AI-driven arrangements

Dissecting the current necessities, our has built up its answers suite to assist guarantors with changing their guaranteeing cycle. Our AI-driven answers for low touch guaranteeing are explicitly intended to help the whole endorsing travel and address the key difficulties related with the current cycle. The AI and Machine Learning calculations encourage guarantors to recognize business openings, hold existing clients, and amplify endorsing benefits while guaranteeing seriousness. The arrangement uses new-age information resources and improves endorsing execution from expanded knowledge. It permits safety net providers to uncover sharp bits of knowledge, catch complex dangers on the lookout, decrease costs, and increment income through better analysis.

Snappy bits of knowledge into our AI-driven arrangements