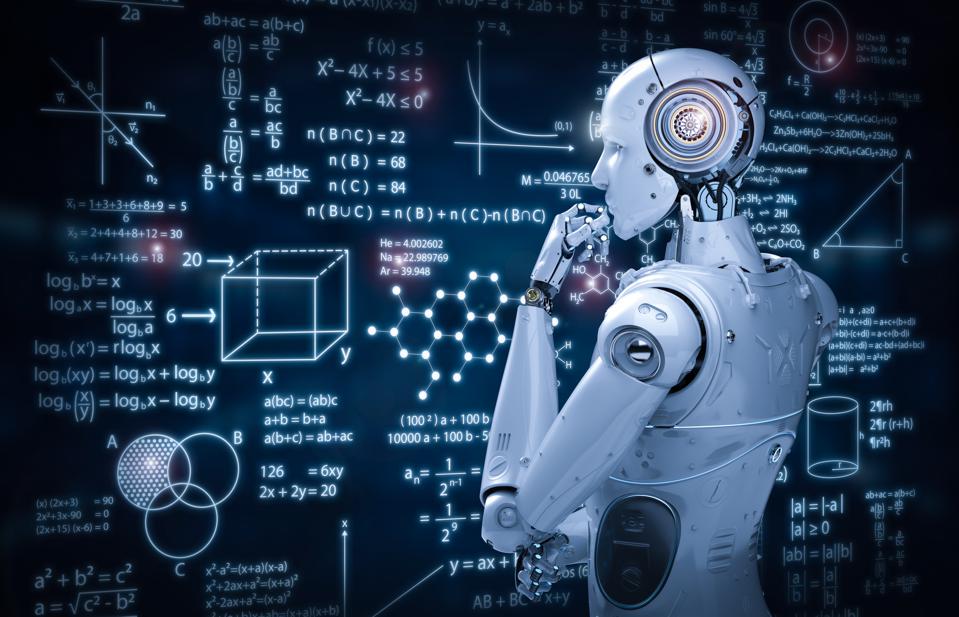

We build you a big ai data pipeline consisting of

Kubeflow

Kubeflow is a free and open-source machine learning platform. It is specifically designed to enable the use of machine learning pipelines. These pipelines help orchestrate complicated workflows running on Kubernetes, allowing for tasks such as data processing, model training using TensorFlow or PyTorch, and seamless deployment to TensorFlow Serving.

Docker

Docker, a set of platform as a service (PaaS) products, offers OS-level virtualization to deliver software in containers. These containers are isolated entities that encapsulate their own software, libraries, and configuration files. Additionally, they can seamlessly communicate with each other via well-defined channels.

Pandas

Pandas, a software library written for the Python programming language, excels in data manipulation and analysis. With a focus on numerical tables and time series, it offers comprehensive data structures and operations for efficient data processing.

Numpy

NumPy, a powerful library for the Python programming language, provides valuable support for large, multi-dimensional arrays and matrices. Moreover, it offers an extensive collection of high-level mathematical functions specifically designed to operate on these arrays.

Tensorflow

TensorFlow, a versatile and open-source software library for machine learning, caters to a wide array of tasks. Notably, it specializes in the training and inference of deep neural networks, making it a preferred choice for various applications.

Sklearn

It includes classification, regression, and clustering algorithms such as support vector machines, random forests, and k-means. Additionally, it integrates well with NumPy and SciPy, the numerical and scientific libraries in Python.